The office of Minneapolis' primary government watchdog is a quiet place these days.

On a recent afternoon at City Hall, auditor Magdy Mossaad sat alone in the two-story space where he oversees reviews of the city's finances. Three years after the City Council reorganized internal auditing and pledged to make it a robust function of city government, Mossaad is now the office's only full-time employee.

"I'm the department now," he said with a laugh. The city budgeted for two employees this year, but the senior auditor recently left for a job at U.S. Bank — it's expected he will be replaced. Undergraduate college interns still help Mossaad with the work, as well as occasional outside consultants.

The city is behind its peers nationally. Mossaad told the city's audit committee last month that only three out of 80 local governments nationally with budgets larger than $1 billion, surveyed by a national group, had fewer than three audit staffers. Minneapolis' budget is about $1.2 billion. In 2009, an outside study of the city's auditing office — then a one-person entity under an independent board — concluded that the city should employ between three and five people. A survey by the Association of Local Government Auditors found that their members had an average of one auditor for every 877 staff members — which would amount to 5.2 audit staffers in Minneapolis.

"The numbers don't lie," said Stephanie Woodruff, an audit software executive and volunteer member of the six-member audit committee, made up of citizens and politicians. "We are one of the lowest in terms of comparable cities. And … that puts us at risk."

Hennepin County, which has a budget of about $1.8 billion, employs 13 people in its internal audit department. Not all local governments have dedicated auditors, however. Included among them is St. Paul, which has a budget about half the size of Minneapolis.

What can auditors catch? Plenty

As city services go, auditing is not likely a top priority for constituents who are more focused on plowing and police. But the office's reports on major city contracts and controls on city finances can save the city money and prevent potential calamities.

A recent review of accounts payable, for example, revealed that there were too few controls on who could create new vendors within the city's financial systems. Another recent report showed that former employees sometimes retain access to sensitive data. A 2012 review of the city's largest contract, with IT firm Unisys, concluded the company was not fulfilling an obligation to prove the city was getting favorable prices. The office will complete about seven audits this year.

"The internal auditor exists to basically keep you out of the newspaper … detect problems before they become a big deal," said Carol Becker, a member of the city's Board of Estimate and Taxation, which oversaw auditing until 2009.

'Failure to follow through'

When the city's budget committee voted to bring the internal audit function under more direct City Council control in 2009, a representative of the mayor's office, Peter Wagenius, said the reorganization was "in tandem" with a tripling of the staff from one to three. A news release celebrating the final vote said four times that the audit staff would be tripled.

Wagenius noted it was the state auditor — which audits the city's financial statements annually — that recognized in the mid-2000s the city was overpaying for benefits on two pension funds, rather than being caught internally. "What would the financial history of the city be like if that issue had been caught two years earlier, or three years earlier, or five years earlier, or seven years earlier?" Wagenius asked the committee.

The city briefly paid for three full-time audit staffers, in 2011, but eliminated one of the positions after an auditor transferred elsewhere in city government. The budget has dropped from $450,726 in 2011 to $382,136 in 2013.

Former Council Member Paul Ostrow, who chaired the budget committee until he left the council in 2009, said there were promises to not let the audit office fall victim to budget cuts. "I think it's fair to say that it's a failure to follow through on a commitment that the council made, generally," he said.

Mayor R.T. Rybak said in an interview that ideally the audit office would have a larger staff. "But each budget, I have to weigh that against the police officers and firefighters and all the other functions we have," he said.

'Out there finding stuff'

Last month, Mossaad showed the audit committee 10 other cities with larger audit departments — Tulsa, Okla., has 13 staffers, Sacramento has four, San Diego has 20. At the meeting, Council President Barb Johnson seemed to take offense, noting that Sacramento and San Diego have had recent city scandals.

"I think we have to be careful when we put out information [saying] we're not doing enough," she said. "Some of these other cities may be doing more, but their outcomes are way worse than ours."

Mark Oyaas, the Minneapolis Park Board's appointee to the audit committee, said he has been surprised how defensive some council members become about auditor findings. He wants to remind them that scrutiny is needed because of the occasional bad actor — several council members went to prison in the past decade — and that "this is a good thing. This is your committee. Your guy is out there finding stuff."

It will likely take three to four months to replace the auditor who recently left, Jacob Claeys. In the meantime, the committee will analyze how to best use his leftover salary on outside consultants.

Council Member Betsy Hodges, author of the 2009 ordinance who now sits on the audit committee, said she is open to expanding the staff to three members, pending more committee discussion about the use of consulting firms.

As for the overall question of "whether or not we can or should put more resources into the audit function, and I would say 'Yea,' " said Hodges, who is running for mayor. "I think that's something we need to take a serious look at."

Eric Roper • 612-673-1732 Twitter: @StribRoper

Marijuana's path to legality in Minnesota: A timeline

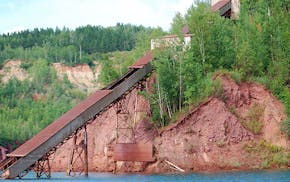

Minnesota to close state park on Iron Range, turn it back into a mine

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year