Commentary

In the second week of March, Minnesotans paid an average of 42 cents more for a gallon of gas than they did just two weeks ago.

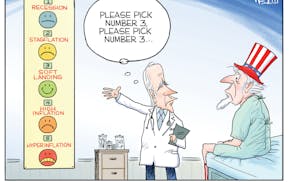

The price spike stems from Mideast unrest and speculation about its future.

But foreign oil interests are planning a deliberate manipulation of the U.S. oil market that would raise gas prices for Midwest farmers and consumers even higher.

Who's behind the plan? Not OPEC.

It's Canada.

The Canadian oil industry, with the strong backing of Prime Minister Stephen Harper's government, wants to build a pipeline to move crude oil from Alberta to the Gulf of Mexico.

The firms involved have asked the U.S. State Department to approve this project, even as they've told Canadian government officials how the pipeline can be used to add at least $4 billion to the U.S. fuel bill.

U.S. farmers, who spent $12.4 billion on fuel in 2009, according to the U.S. Department of Agriculture, could see expenses rise to $15 billion or higher in 2012 or 2013 if the pipeline goes through.

At least $500 million of the added expense would come from the Canadian market manipulation.

Of course, American consumers will pay the price of this highway robbery. Food prices will rise because they reflect farm operating costs.

In addition, millions of Americans will spend 10 to 20 cents more per gallon for gasoline and diesel fuel as tribute to our "friendly" neighbors to the north.

The Keystone XL pipeline will move production from Canadian oil sands to a deepwater port from where it can be exported.

Environmentalists have long opposed Keystone because tar sands production is "dirty" due to the high carbon emissions and the ecological damage caused by extracting and processing the oil.

They also point to elevated safety and health risks associated with piping and refining the heavy crude.

To date, however, these opponents have ignored public statements by the pipeline's backers regarding how they would use the facility to boost what Americans pay for oil by almost $5 billion per year.

Most of the increase would come in the 14-state refining and marketing region that includes Minnesota.

The Canadians intend to exact this tribute by bypassing refineries in Chicago and the Midwest until the prices paid by these facilities return to their historically high levels.

In the past, Midwestern refiners paid more for oil than their counterparts in Texas and Louisiana because oil had to be shipped north.

Recently, though, these refiners have gotten a break as Canadian output has increased. Oil now flows south, not north. Midwestern refiners can save significant sums, savings that ultimately get passed on to consumers.

Executives at Canadian oil companies want to end this discount. They propose building the Keystone line to go around Midwest refineries.

They correctly argue that the line is needed to move additional crude volumes to the Gulf. However, hidden in their presentations to Canadian National Energy Board officials is their declared intent to use the pipeline to raise prices to Americans.

Canadian oil officials pushing the pipeline have been supported by energy security experts who argue the project will reduce dependence on imported oil and moderate the impact of supply disruptions. They may be correct.

However, their arguments in favor of the pipeline neglect one point: The United States has already paid billions to create a 700-million-barrel strategic reserve designed to provide the same protection.

These experts apparently think Americans should pay an additional $5 billion per year to further reduce the risk of market interruptions. The nation's consumers cannot afford this and have no need to do so.

Our existing insurance policy is more than adequate.

Proposals to build the Keystone pipeline, in their present form, should be rejected. U.S. consumers should not have to pay a $5 billion duty to Canadian oil companies for an insurance policy of little value.

The entire project should be redesigned to address environmental concerns and to make sure Canadian oil companies cannot tax American consumers and farmers.

Philip K. Verleger is president of PKVerleger LLC, a consulting firm in Carbondale, Colo., that specializes in research on oil market economics. He is also the David Mitchell EnCana Professor of Strategy and International Management at the Haskayne School of Business at the University of Calgary.